37+ How much will it cost to borrow 50000

Fixed or variable rates. 36 Months at 1995 APR 3719 Comparison Rate.

Wirex Review The College Investor

You may borrow against or make withdrawals from the universal life policys cash value.

. Borrow up to 100000. They rung up and said we want 100 percent or take it out of the shops you dont have much choice. Ill pay you you know 50000 dollars 100000 dollars whatever you want.

Simply enter how much you want to borrow how long you want the loan for the value of your property and mortgage then well find you the loan that could best suit your situation. I will fing do one humongous deal with you. If you owe 300000 but have 50000 in an offset account youll be charged interest as if you only owed 250000.

Borrow from her 401k at an interest rate of 4. 50000 death benefit 50000. There are seven tax brackets for most ordinary income for the 2021 tax year.

5 years 60 months Flat interest rate. Bidens decision to move ahead with 10000 in student debt cancellation for borrowers who earn under 125000 will cost the federal government around 244 billion according to higher education. The Rolling Stones said they acknowledged the financial and emotional cost of having to surrender the composition of one of your own songs.

Each month you are only required to pay interest on the outstanding balance. From 95 up to 250. The average cost for a burial insurance policyholder is approximately 50-100 per month and the most common face amount is 10000.

RateCity has a number of home loan calculators that could come in handy when figuring out how much you can afford to borrow. From 195 up to 295. Your tax bracket depends on your taxable income and your filing status.

Use a personal loan calculator to estimate how much your 5000 loan could cost you. How Much Does Burial Insurance Cost. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

Unsecured borrowing that helps businesses spread the cost of a purchase over a set period 7. Lenders on our panel offer loans from 1000 to 50000 with. Residential real estate has been up to 27 per square foot from February 2020 to February 2021 an increase of nearly 20.

However the amount of interest you pay can be reduced by offsetting your savings with us. Borrow up to 50000 unsecured the money could be available to you in days. The amount of interest you pay via your monthly instalment reduces over time while the amount of principal you pay via your monthly instalment increases to keep the amount of your monthly instalments unchanged.

Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. With a 401k loan you borrow money from your retirement savings account. The comparison rate may not accurately reflect exactly how much your home loan may cost.

If you do that. With a loan range of 250. Use it for needs that may come up such as emergencies college tuition or to supplement retirement income.

Your specific premium might be higher or lower depending on your age gender health and the amount of coverage you purchase. The representative APR example gives you an estimate of how much it might cost if you borrowed a certain amount of money. If 15 of your home is dedicated to an office space you can deduct 15 the cost of your mortgage from your taxes.

To calculate the LTV ratio divide 150000 by 200000. 36 or 60 months. 278 Effective interest rate 524.

Im a man of my word. The average cost of car insurance in the United States is 1771 per year for full coverage. In this example the LTV ratio is 75.

Reducing your overall tax burden. I need you to keep it as low as possible. 10 12 22 24 32 35 and 37.

Like a 50000 buck deal whatever. Gold 500000. Borrow from the bank at a real interest rate of.

Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period. Over the last year the average price of US. We use this to work out how much you can afford to borrow and to tailor your loan term and repayments.

The cost of living in the most expensive state vs the cheapest state differs quite a lot and you could actually be getting much more for your money somewhere else. Bad credit history and Centrelink incomes considered. If you keep 6s ie the six-month JPY Libor rate unchanged today.

Get quick personal loans up to 12000 and car loans up to 50000 with Money3. Premiums are based on the age you take out the insurance and length of term period. How to use our 50000 repayment calculator.

Well give you a fair go. Lower cost per month. However the exact cost of coverage varies from person to person so if youre wondering how much.

For example if you saved a 50000 deposit for a 200000 home your loan amount would be 150000. Available to sole applicants with a minimum salary of 50000 or joint applicants with combined salaries of 75000 or where one party has an individual salary of 50000. Therefore if your taxable income is 50000 and you paid 5000 in mortgage interest your taxable income would be reduced to 45000.

A small loan through this lender may be ideal for consumers looking to borrow under 1000. You can use our loan calculator to compare a range of 50000 loans from popular lenders based on monthly payment size and APR.

2

Vystar Credit Union Review High Interest Rates On Cds

Final Additional Bonus For Lic Policies Fab Sum Assured Bonus Policies Fab

Catalog Main Content

M1 Finance Review Low Cost Investing Spending And More Investing Start Investing Finance

Land Loan Calculator And Lot Loans Macu

2

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Household Income Income Map

The Salary You Need To Afford The Average Home In Your State Based On A 30 Year Mortgage With A 10 Map Usa Map 30 Year Mortgage

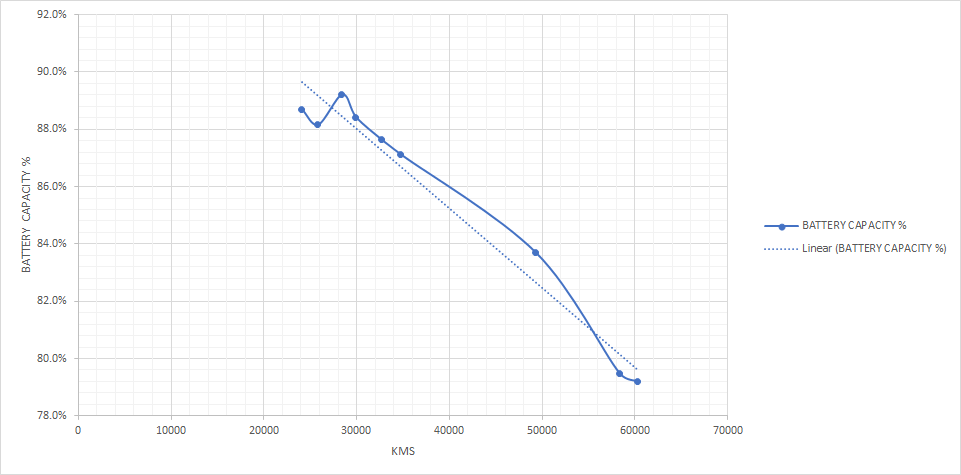

Phev Battery Degradation And Warranty Page 2 Speak Ev Electric Car Forums

I Am 18 Uk I Have Started A Small Business It Is Starting To Become Quite A Success At What Point Should I Register It With Hms And Pay Tax Etc Quora

The Student Loan Debt Bubble Infographic What Is A 529 Plan Student Debt Student Loans Student Loan Debt

2

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Salary 30 Year Mortgage Average

Melissa Address Key Mak Melissa

2

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Budgeting